Code

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

import seaborn as sns

plt.rcParams['figure.figsize'] = (10, 5)

plt.style.use('fivethirtyeight')kakamana

January 27, 2023

How you choose and construct a model for predicting patterns from data over time requires special consideration. Predictive modeling for time series data is discussed in this chapter, along with best practices on how to gain insights into the data before fitting your model.

This Predicting Time Series Data is part of Datacamp course: Machine Learning for Time Series Data in Python

This is my learning experience of data science through DataCamp

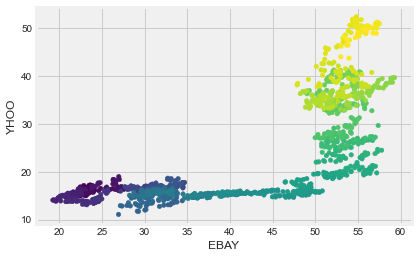

| EBAY | YHOO | |

|---|---|---|

| date | ||

| 2010-01-04 | 23.900000 | 17.100000 |

| 2010-01-05 | 23.650000 | 17.230000 |

| 2010-01-06 | 23.500000 | 17.170000 |

| 2010-01-07 | 23.229998 | 16.700001 |

| 2010-01-08 | 23.509999 | 16.700001 |

Now we’ll look at a larger number of companies. Recall that we have historical price values for many companies. Let’s use data from several companies to predict the value of a test company. You’ll attempt to predict the value of the Apple stock price using the values of NVidia, Ebay, and Yahoo. Each of these is stored as a column in the all_prices DataFrame. Below is a mapping from company name to column name:

ebay: "EBAY"

nvidia: "NVDA"

yahoo: "YHOO"

apple: "AAPL"We’ll use these columns to define the input/output arrays in our model.

| AAPL | ABT | AIG | AMAT | ARNC | BAC | BSX | C | CHK | CMCSA | ... | QCOM | RF | SBUX | T | V | VZ | WFC | XOM | XRX | YHOO | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| date | |||||||||||||||||||||

| 2010-01-04 | 214.009998 | 54.459951 | 29.889999 | 14.30 | 16.650013 | 15.690000 | 9.01 | 3.40 | 28.090001 | 16.969999 | ... | 46.939999 | 5.42 | 23.049999 | 28.580000 | 88.139999 | 33.279869 | 27.320000 | 69.150002 | 8.63 | 17.100000 |

| 2010-01-05 | 214.379993 | 54.019953 | 29.330000 | 14.19 | 16.130013 | 16.200001 | 9.04 | 3.53 | 28.970002 | 16.740000 | ... | 48.070000 | 5.60 | 23.590000 | 28.440001 | 87.129997 | 33.339868 | 28.070000 | 69.419998 | 8.64 | 17.230000 |

| 2010-01-06 | 210.969995 | 54.319953 | 29.139999 | 14.16 | 16.970013 | 16.389999 | 9.16 | 3.64 | 28.650002 | 16.620001 | ... | 47.599998 | 5.67 | 23.420000 | 27.610001 | 85.959999 | 31.919873 | 28.110001 | 70.019997 | 8.56 | 17.170000 |

| 2010-01-07 | 210.580000 | 54.769952 | 28.580000 | 14.01 | 16.610014 | 16.930000 | 9.09 | 3.65 | 28.720002 | 16.969999 | ... | 48.980000 | 6.17 | 23.360001 | 27.299999 | 86.760002 | 31.729875 | 29.129999 | 69.800003 | 8.60 | 16.700001 |

| 2010-01-08 | 211.980005 | 55.049952 | 29.340000 | 14.55 | 17.020014 | 16.780001 | 9.00 | 3.59 | 28.910002 | 16.920000 | ... | 49.470001 | 6.18 | 23.280001 | 27.100000 | 87.000000 | 31.749874 | 28.860001 | 69.519997 | 8.57 | 16.700001 |

5 rows × 50 columns

from sklearn.linear_model import Ridge

from sklearn.model_selection import cross_val_score

# Use stock symbols to extract training data

X = all_prices[['EBAY', 'NVDA', 'YHOO']]

y = all_prices[['AAPL']]

# Fit and score the model with cross-validation

scores = cross_val_score(Ridge(), X, y, cv=3)

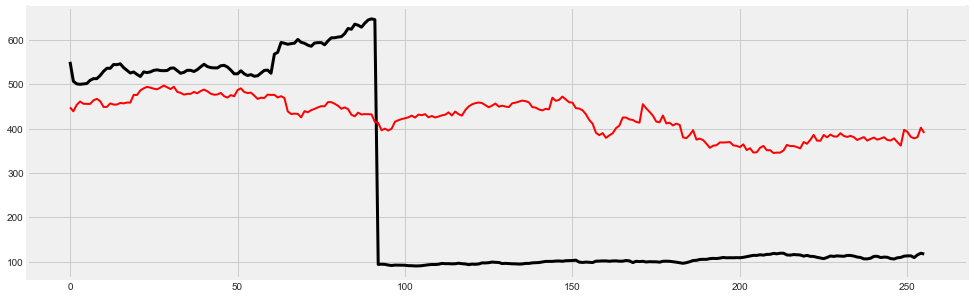

print(scores)[-6.09050633 -0.3179172 -3.72957284]When dealing with time series data, it’s useful to visualize model predictions on top of the “actual” values that are used to test the model.

In this exercise, after splitting the data (stored in the variables X and y) into training and test sets, you’ll build a model and then visualize the model’s predictions on top of the testing data in order to estimate the model’s performance.

from sklearn.model_selection import train_test_split

from sklearn.metrics import r2_score

# Split our data into training and test sets

X_train, X_test, y_train, y_test = train_test_split(X, y, train_size=0.8,

shuffle=False, random_state=1)

# Fit our model and generate predictions

model = Ridge()

model.fit(X_train, y_train)

predictions = model.predict(X_test)

score = r2_score(y_test, predictions)

print(score)-0.3380697256228944# Visualize our predictions along with the "true" values, and print the score

fig, ax = plt.subplots(figsize=(15, 5))

ax.plot(range(len(y_test)), y_test, color='k', lw=3);

ax.plot(range(len(predictions)), predictions, color='r', lw=2);

print("\nThe predictions clearly deviate from the true time series values")

The predictions clearly deviate from the true time series values

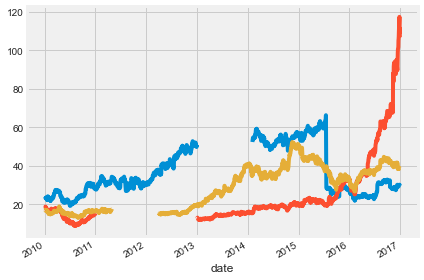

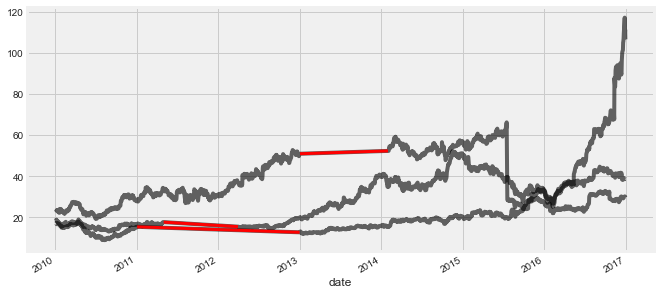

Let’s take a look at a new dataset - this one is a bit less-clean than what you’ve seen before.

As always, you’ll first start by visualizing the raw data. Take a close look and try to find datapoints that could be problematic for fitting models.

# Visualize the dataset

prices.plot(legend=False);

plt.tight_layout();

# Count the missing values of each time series

missing_values = prices.isnull().sum()

print(missing_values)

print("\nIn the plot, you can see there are clearly missing chunks of time in your data. There also seem to be a few 'jumps' in the data")EBAY 273

NVDA 502

YHOO 232

dtype: int64

In the plot, you can see there are clearly missing chunks of time in your data. There also seem to be a few 'jumps' in the data

When you have missing data points, how can you fill them in?

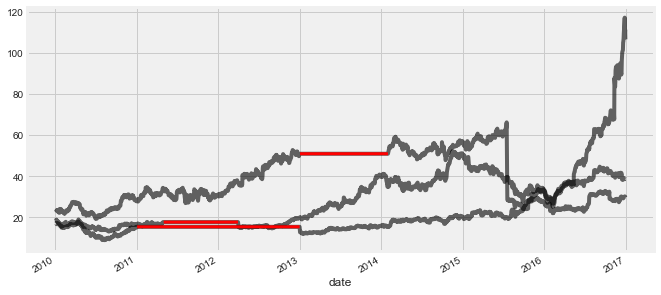

In this exercise, you’ll practice using different interpolation methods to fill in some missing values, visualizing the result each time. But first, you will create the function (interpolate_and_plot()) you’ll use to interpolate missing data points and plot them.

# Create a function we'll use to interpolate and plot

def interpolate_and_plot(prices, interpolation):

# Create a boolean mask for missing values

missing_values = prices.isna()

# Interpolate the missing values

prices_interp = prices.interpolate(interpolation)

# Plot the results, highlighting the interpolated values in black

fig, ax = plt.subplots(figsize=(10, 5))

prices_interp.plot(color='k', alpha=0.6, ax=ax, legend=False);

# Note plot the interpolated values on top in red

prices_interp[missing_values].plot(ax=ax, color='r', lw=3, legend=False);

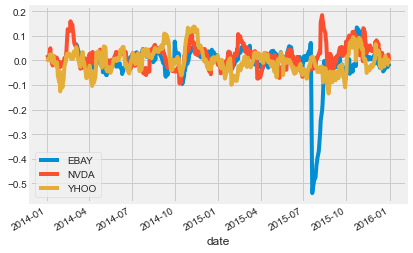

In the last chapter, you calculated the rolling mean. In this exercise, you will define a function that calculates the percent change of the latest data point from the mean of a window of previous data points. This function will help you calculate the percent change over a rolling window.

This is a more stable kind of time series that is often useful in machine learning.

# Your custom function

def percent_change(series):

# Collect all *but* the last value of this window, then the final value

previous_values = series[:-1]

last_value = series[-1]

# Calculate the % difference between the last value and the mean of earlier values

percent_change = (last_value - np.mean(previous_values)) / np.mean(previous_values)

return percent_change

# Apply your custom function and plot

prices_perc = prices.rolling(20).apply(percent_change)

prices_perc.loc["2014":"2015"].plot();

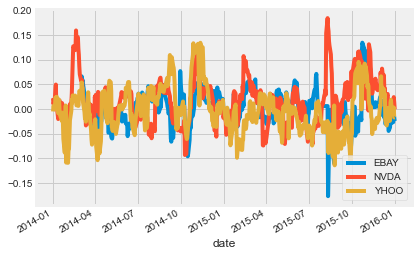

In this exercise, you’ll handle outliers - data points that are so different from the rest of your data, that you treat them differently from other “normal-looking” data points. You’ll use the output from the previous exercise (percent change over time) to detect the outliers. First you will write a function that replaces outlier data points with the median value from the entire time series.

def replace_outliers(series):

# Calculate the absolute difference of each timepoint from the series mean

absolute_differences_from_mean = np.abs(series - np.mean(series))

# Calculate a mask for the difference that are > 3 standard deviations from zero

this_mask = absolute_differences_from_mean > (np.std(series) * 3)

# Replace these values with the median across the data

series[this_mask] = np.nanmedian(series)

return series

# Apply your preprocessing functino to the timeseries and plot the results

prices_perc = prices_perc.apply(replace_outliers)

prices_perc.loc["2014":"2015"].plot();

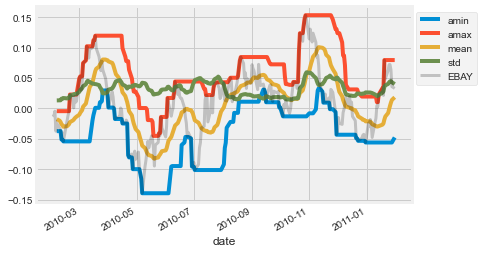

Now that you’ve practiced some simple feature engineering, let’s move on to something more complex. You’ll calculate a collection of features for your time series data and visualize what they look like over time. This process resembles how many other time series models operate.

# Define a rolling window with Pandas, excluding the right-most datapoint of the window

prices_perc_rolling = prices_perc['EBAY'].rolling(20, min_periods=5, closed='right')

# Define the features you'll calculate for each window

features_to_calculate = [np.min, np.max, np.mean, np.std]

# Calculate these features for your rolling window object

features = prices_perc_rolling.aggregate(features_to_calculate)

# Plot the results

ax = features.loc[:"2011-01"].plot();

prices_perc['EBAY'].loc[:"2011-01"].plot(ax=ax, color='k', alpha=0.2, lw=3);

ax.legend(loc=(1.01, 0.6));

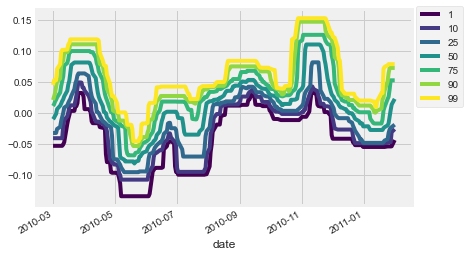

In this exercise, you’ll practice how to pre-choose arguments of a function so that you can pre-configure how it runs. You’ll use this to calculate several percentiles of your data using the same percentile() function in numpy.

from functools import partial

percentiles = [1, 10, 25, 50, 75, 90, 99]

# Use a list comprehension to create a partial function for each quantile

percentile_functions = [partial(np.percentile, q=percentile) for percentile in percentiles]

# Calculate each of these quantiles on the data using a rolling window

prices_perc_rolling = prices_perc['EBAY'].rolling(20, min_periods=5, closed='right')

features_percentiles = prices_perc_rolling.aggregate(percentile_functions)

# Plot a subset of the result

ax = features_percentiles.loc[:"2011-01"].plot(cmap=plt.cm.viridis);

ax.legend(percentiles, loc=(1.01, 0.5));

It’s easy to think of timestamps as pure numbers, but don’t forget they generally correspond to things that happen in the real world. That means there’s often extra information encoded in the data such as “is it a weekday?” or “is it a holiday?”. This information is often useful in predicting timeseries data.